Loading

Get 2014 Form 541-b -- Charitable Remainder And Pooled Income Trusts - Ftb Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

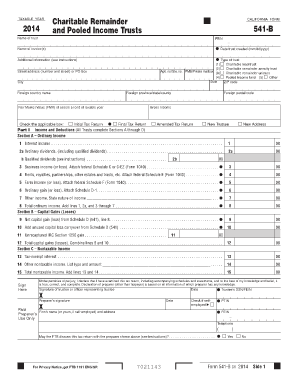

How to fill out the 2014 Form 541-B -- Charitable Remainder and Pooled Income Trusts - Ftb Ca online

Filling out the 2014 Form 541-B, which is used for Charitable Remainder and Pooled Income Trusts in California, can be handled efficiently online. This guide provides comprehensive and clear instructions to assist users through each section of the form.

Follow the steps to complete the form with ease.

- Press the ‘Get Form’ button to access the form and open it in your preferred browser.

- Provide the name of the trust and its federal employer identification number (FEIN) in the respective fields. Ensure the information is accurate as it establishes the identity of the trust.

- Enter the name of the trustee or trustees, along with the date the trust was created in the format (mm/dd/yyyy). This information is crucial for both identification and record-keeping.

- Specify the type of trust by checking the appropriate box. Choose from options like charitable lead trust, charitable remainder annuity trust, charitable remainder unitrust, or pooled income fund.

- Complete the address section, ensuring the street address, city, state, and ZIP code are correct. If applicable, include information for foreign entities.

- In the section pertaining to the fair market value (FMV) of assets at the end of the taxable year, accurately document this value. This is critical for tax calculations.

- Indicate whether this is an initial tax return, final tax return, amended tax return, or if there is a new trustee or address. Select the applicable option.

- Proceed to Part I of the form, where you will detail income and deductions. Fill out Section A for ordinary income, providing figures for interest income, dividends, and business income.

- Continue with capital gains and losses in Section B, and ensure you accurately calculate and report these figures.

- Complete the deductions section as instructed, including allowable deductions related to interest, taxes, and trustee fees.

- Finalize your entries by signing and dating the form in the designated section. Accuracy in this step ensures that all prior information is legally binding.

- Once all information is entered correctly, you can now save changes, download a copy for your records, print the form, or share it as needed.

Begin filling out your documents online today!

The fiduciary (or one of the fiduciaries) must file Form 541 for a trust if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $100. An alternative minimum tax liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.