Loading

Get Form S-211 - Wisconsin Department Of Revenue Portal

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form S-211 - Wisconsin Department Of Revenue Portal online

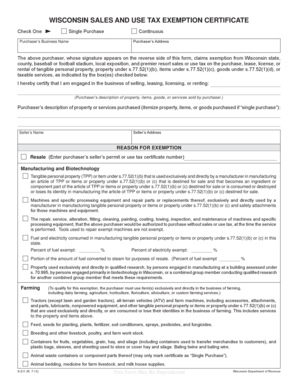

Filling out Form S-211, the Wisconsin Sales and Use Tax Exemption Certificate, is essential for individuals and organizations seeking exemption from sales tax on specific purchases. This guide provides clear instructions to assist users in completing the form online with ease and accuracy.

Follow the steps to complete the Form S-211 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by selecting the appropriate option for your exemption claim, either 'Single Purchase' or 'Continuous.' This choice will dictate how the exemption is applied.

- Provide the purchaser’s business name and address in the designated fields to ensure proper identification.

- In the section regarding the description of property or services, detail the items that qualify for exemption. This may include tangible personal property, services, or specific manufacturing equipment.

- Complete the seller’s name and address to provide information about the transaction partner involved in the sale.

- Specify the reason for exemption by selecting one of the provided categories such as resale, manufacturing, or farming, and include any required permit or certificate numbers.

- If applicable, indicate the percent of fuel and electricity to be exempt according to the guidelines provided for manufacturing or farming.

- Fill in details about any other specific exemptions being claimed under other categories by providing relevant descriptions and numbers where necessary.

- Sign the form at the end. The signature must be from the purchaser or an authorized representative, along with their printed name, title, and date.

- After completing all relevant sections, you can save changes, download, print, or share the form as needed.

Complete your sales tax exemption forms online today with ease!

A resale certificate is also called a sales tax certificate, reseller permit, or sales tax exemption certificate. ... It does not exempt you from paying sales tax on items you use in your business (e.g., office supplies). Qualifying goods are either items you plan to resell or use as parts in products or services you sell.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.