Loading

Get Form St-101-att:2/14:new York State And Local Annual Sales And ... - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST-101-ATT:2/14: New York State And Local Annual Sales And Use Tax Credit Worksheet online

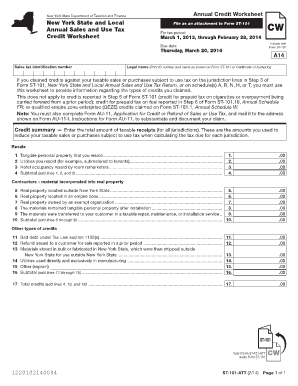

Filling out the Form ST-101-ATT, which accompanies the New York State and Local Annual Sales and Use Tax Return, is essential for claiming certain tax credits. This guide will walk you through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to successfully fill out the form.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Review the instructions presented on the form regarding the various types of credits you can claim. This includes the requirements for credits against taxable sales or purchases, as referenced in Step 3 of Form ST-101.

- Enter your sales tax identification number in the designated field. This is crucial for properly associating the credits to your account.

- Fill in your legal name as it appears on Form ST-101 or your Certificate of Authority. Accuracy in this field is important to ensure your submission is processed correctly.

- Complete the credit summary section by entering the total amounts for each category related to credits claimed. Be sure to aggregate all pertinent line items as instructed.

- If applicable, provide details on tangible personal property and any specific credits related to contractors or other categories, ensuring the subtotals are calculated correctly.

- Double-check all entered information for accuracy and completeness before saving. Any discrepancies may delay processing.

- Save changes, download, print, or share the completed form as needed. Make sure to follow any additional instructions related to mailing the Form ST-101, if required.

Complete your documents online to streamline your filing process today!

Sales tax nexus defines the level of connection between a taxing jurisdiction such as a state and an entity such as your business. Until this connection is established, the taxing jurisdiction cannot impose its sales taxes on you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.