Loading

Get 1095-c - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 1095-C - IRS online

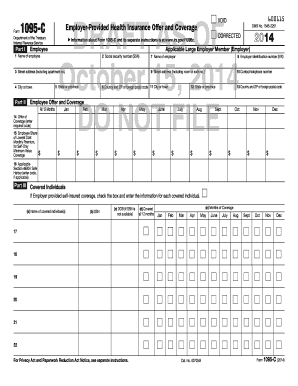

Filling out Form 1095-C, the Employer-Provided Health Insurance Offer and Coverage, is essential for employees to report health coverage information to the IRS. This guide provides clear instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out your 1095-C form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, fill in the employee details. Provide the name of the employee in line 1, and enter their Social Security Number (SSN) in line 2. Include the employee's street address, city, state, and ZIP code in lines 3 to 6.

- In Part I, provide information about the employer. Enter the employer's name in line 7, the Employer Identification Number (EIN) in line 8, and the employer's address in lines 9 through 13.

- In Part II, line 14 requires you to enter the appropriate code that describes the coverage offered by your employer. Choose from the codes that outline the coverage details for you and your spouse or dependents.

- Line 15 asks for the employee's share of the lowest-cost monthly premium for self-only minimum essential coverage. Enter the amount in the provided spaces for each month.

- In line 16, if applicable, enter the code for the relevant safe harbor provisions that apply to the employer.

- Part III requires information about covered individuals under the employer's health plan if it is self-insured. For each covered individual, fill in the name, SSN, date of birth (if SSN is not available), and months of coverage.

- Once all sections are completed, review the form for errors, then save your changes. You can download or print the form for your records or share it if necessary.

Start filling out your 1095-C form online today to ensure compliance and accurate reporting.

Although information from the Form 1095-C – information about an offer of employer provided coverage - can assist you in determining eligibility for the premium tax credit, it is not necessary to have Form 1095-C to file your return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.