Loading

Get - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

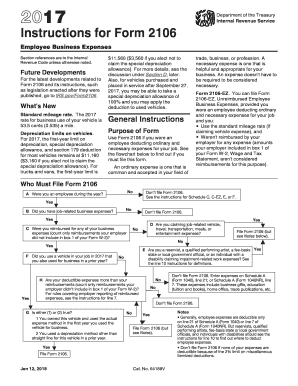

How to fill out the IRS Form 2106 online

Filling out IRS Form 2106 for employee business expenses can seem challenging. This guide provides a clear and supportive approach, guiding users through each section of the form online for efficient completion.

Follow the steps to successfully fill out IRS Form 2106.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out Part I of the form, which covers employee business expenses. Enter your job-related expenses, ensuring to separate reimbursed expenses highlighted in line 7.

- For each expense type, refer to the specific lines: Line 1 for vehicle expenses, Line 3 for lodging and transportation tied to overnight travel, and Line 4 for other job-related expenses.

- Accurate documentation is essential. Keep detailed records and receipts that support your entries, especially for meals and entertainment, as well as vehicle details if applicable.

- Proceed to Part II if claiming vehicle expenses. Choose between the standard mileage rate and actual costs for calculating deductions.

- Review all entries for accuracy. Ensure all required information is completed, including any applicable deductions or allowances attached to the specific nature of your employment.

- Once all fields are completed, you have the option to save your changes, download the completed document, print it for your records, or share it as needed.

Complete your IRS Form 2106 online today for a streamlined filing experience.

If you get a phone call saying you won't receive government stimulus money unless you give the caller your personal information, IT IS A SCAM. Hang up the phone. In general, if you get any kind of suspicious phone call, don't give the caller any information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.