Loading

Get Ia 1041 Fiduciary Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IA 1041 Fiduciary Return online

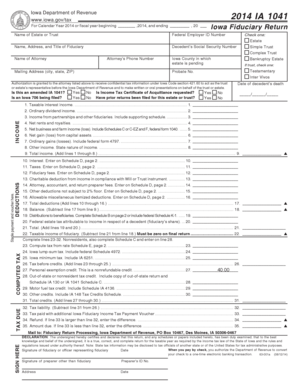

Filing the IA 1041 Fiduciary Return online can seem daunting, but with this comprehensive guide, users will find the process clear and manageable. This document serves as a crucial tax return for estates and trusts, ensuring compliance with Iowa state tax regulations.

Follow the steps to complete the IA 1041 Fiduciary Return online

- Click the ‘Get Form’ button to access the IA 1041 Fiduciary Return and open it in your preferred digital document editor.

- Begin by entering the name of the estate or trust at the top of the form. Ensure that you also fill in the Federal Employer ID Number, the name, address, and title of the fiduciary, as well as the decedent’s Social Security number.

- Check the appropriate box to indicate whether you are filing for an estate, simple trust, or complex trust. Additionally, provide the name and phone number of the attorney handling the estate, along with the mailing address.

- Indicate the Iowa county in which the estate is pending, and specify if the case involves a bankruptcy estate. For trusts, check whether it is testamentary or inter vivos.

- Answer the questions regarding whether this is an amended IA 1041, if an Iowa 706 is being filed, and if an Income Tax Certificate of Acquittance is requested. Also, confirm whether prior returns have been filed for the estate or trust.

- Input the date of the decedent’s death in the specified format.

- Proceed to the income section where you will report various income types, including taxable interest income, ordinary dividends, income from partnerships, net rents, and any other applicable categories.

- Carefully tally the total income from all specified lines to complete the total income section.

- In the deductions section, enter the amounts for fiduciary fees and other relevant deductions. Make sure to include any attorney or accountant fees and total these amounts.

- Calculate the taxable income of the fiduciary by subtracting the total deductions from the total income.

- Follow through to compute the tax based on the provided rate schedules, including any applicable credits.

- Complete the tax due section and determine if there is a refund or amount due based on previous payments.

- Make sure to sign and date the declaration section of the form, certifying that the information is accurate before submitting the form.

- Once completed, you have the option to save your changes, download the form, print it, or share it as necessary.

Take the next step in your document management and submit your IA 1041 Fiduciary Return online today.

Almost everyone must file a state income tax return in Iowa, including: Residents with at least $9,000 in net income for individuals or $13,500 for married taxpayers. Part-year residents (for the part of the year they resided in Iowa)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.