Loading

Get Pa Schedule Ue (fi)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA SCHEDULE UE (FI) online

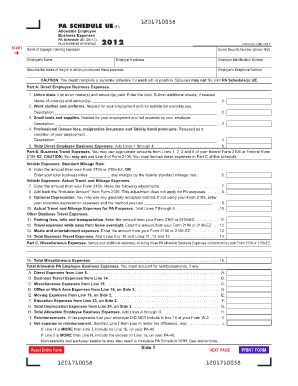

Filling out the PA SCHEDULE UE (FI) form online allows users to report employee business expenses accurately and efficiently. This guide provides step-by-step instructions to ensure that you complete the form correctly and meet all necessary requirements.

Follow the steps to fill out the PA SCHEDULE UE (FI) form online

- Click the ‘Get Form’ button to access the PA SCHEDULE UE (FI) and open it in your preferred online editor.

- Provide your personal information. Enter the name of the taxpayer claiming expenses, the social security number, and detailed employer information including the name and address.

- Complete Part A for Direct Employee Business Expenses. List the amounts for union dues, work clothes and uniforms, small tools and supplies, and required professional fees. Ensure to calculate and enter the total.

- Move to Part B for Business Travel Expenses. Decide between using amounts from previous federal forms or calculating your vehicle expenses from your total business mileage.

- Itemize additional business travel expenses such as parking fees and travel costs while away from home overnight, and calculate the total.

- Continue to Part C for Miscellaneous Expenses. Document any additional expenses not included previously.

- For Part D, answer all questions about office or work area expenses. If applicable, enter your expenses and calculate the business percentage.

- Address Part E for Moving Expenses by entering specific mileage information and transportation costs related to your move.

- In Part F, answer questions related to educational expenses required for your job and enter tuition, course materials, and travel expenses, then calculate the total.

- Complete Part G for Depreciation Expenses, entering all necessary information regarding property and expenses.

- Finally, review your entries, and ensure that you include any reimbursements before calculating the net expenses. Users can then save changes, download, print, or share the completed form.

Start completing your PA SCHEDULE UE (FI) form online today!

PURPOSE OF SCHEDULE Use PA-40 Schedule UE to report unreimbursed employee business expenses incurred in the performance of the duties of the taxpayer's job or profession.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.