Loading

Get City Of Dayton Dw1 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the City of Dayton Dw1 form online

Filling out the City of Dayton Dw1 form online can be a straightforward process when you understand each section and its requirements. This guide will provide detailed instructions to help you complete the form with confidence.

Follow the steps to fill out the City of Dayton Dw1 form online easily.

- Click ‘Get Form’ button to access the form and open it for filling.

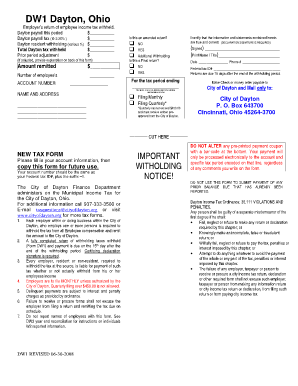

- Enter your employer's account number, which should match your Federal tax ID# with a suffix –1.

- Provide the name and address of your business in the designated fields.

- Fill in the total Dayton payroll for the period in the corresponding section.

- Calculate and input the Dayton payroll tax by applying the rate of 2.25% to the Dayton payroll amount.

- Note the Dayton resident withholding based on the various percentage rates applicable.

- Sum the total Dayton tax withheld and enter the amount in the relevant field.

- If applicable, indicate any prior period adjustments and provide necessary explanations on the back of the form.

- List the total amount you are remitting to the city.

- Specify the number of employees covered by this return.

- Sign and print your name and title in the signature block, along with the date and your phone number.

- Verify the tax period ending date, ensuring to state the month and year this payment applies to.

- Check the appropriate boxes for additional withholding and indicate if this is a final return.

- Ensure all fields are correctly completed before saving your changes. You may also download, print, or share the completed form.

Begin filling out your City of Dayton Dw1 form online today to ensure compliance and timely submission.

Dayton, Ohio sales tax rate details The minimum combined 2021 sales tax rate for Dayton, Ohio is 7.5%. This is the total of state, county and city sales tax rates. The Ohio sales tax rate is currently 5.75%. The County sales tax rate is 1.75%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.