Loading

Get At Any Time During 2014, Did You Have A Financial Interest In Or Signature Authority Over A

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the At Any Time During 2014, Did You Have A Financial Interest In Or Signature Authority Over A online

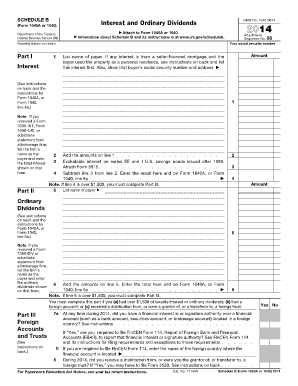

Filling out the At Any Time During 2014, Did You Have A Financial Interest In Or Signature Authority Over A document is an essential process for accurately reporting financial interests and ensuring compliance with tax regulations. This guide provides clear, step-by-step instructions to help you complete the form online with confidence.

Follow the steps to successfully fill out the form online.

- Click the ‘Get Form’ button to access the At Any Time During 2014, Did You Have A Financial Interest In Or Signature Authority Over A document and open it in your preferred online editor.

- Locate the section titled 'Name(s) shown on return'. Here, you will enter the names of all individuals who are filing the form.

- Proceed to Part I and begin reporting your interest. If you received multiple sources of interest income, list each payer's name and the amount of interest earned next to their name.

- Continue to Part II for ordinary dividends. Similar to Part I, list each payer’s name associated with any ordinary dividends and the respective amounts.

- Navigate to Part III which addresses foreign accounts and trusts. Answer the questions regarding financial interests in foreign accounts, ensuring to check 'Yes' or 'No' as applicable.

- If you checked 'Yes' for having a financial interest or signature authority, take note to follow the instructions for filing FinCEN Form 114 if required.

- Once all relevant fields are filled out correctly, review the entries for accuracy before saving your progress.

- Finally, after confirming that all necessary information is provided, you can choose to save your changes, download, print, or share the completed form.

Start completing your At Any Time During 2014 form online today to ensure accurate reporting and compliance!

FBAR Signatory Authority of Foreign Bank Accounts The FBAR (Report of Foreign Bank and Financial Accounts) is a form that is filed directly with the Department of Treasury. It is required to be filed by any individual who has more than $10,000 in annual aggregate total of their foreign accounts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.