Loading

Get - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Schedule A form online

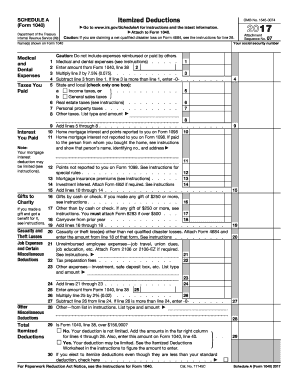

Schedule A (Form 1040) is used to report itemized deductions that can reduce your taxable income. This guide provides clear and detailed steps on how to fill out this form online, helping you to accurately report your deductions and maximize your tax benefits.

Follow the steps to effectively complete your Schedule A form online.

- Press the ‘Get Form’ button to access the Schedule A form and open it in your preferred document editor. This will allow you to interact with the form electronically.

- Enter your name(s) as shown on Form 1040 at the top of the Schedule A form.

- For medical and dental expenses, input the total amount in the designated field. Refer to Form 1040, line 38 for this figure.

- Calculate 7.5% of the amount from line 2 and enter this value in the appropriate box.

- Subtract the amount from line 3 from line 1. If the result is negative, enter -0-.

- Choose between income taxes or general sales taxes by checking the relevant box. Enter amounts for real estate taxes and personal property taxes as applicable.

- Add amounts from lines 5 through 8 to determine your total taxes paid.

- Input your home mortgage interest and points, as reported on Form 1098, in the relevant sections.

- If you have mortgage interest that is not reported on Form 1098, list the name and address of the individual to whom payment was made.

- Outline any gifts made by cash or check. If they were valued at $250 or more, refer to the instructions provided.

- Sum the totals for charitable contributions and any casualty or theft losses as applicable.

- For job-related expenses, enter unreimbursed employee expenses and any other miscellaneous deductions in the corresponding fields.

- Determine if your total deductions need to be adjusted based on the limits set for higher income brackets.

- After completing all sections, review your entries for accuracy. Save your changes, download, print, or share the completed Schedule A form as needed.

Start filling out your Schedule A form online today to ensure you maximize your deductions!

If you get a phone call saying you won't receive government stimulus money unless you give the caller your personal information, IT IS A SCAM. Hang up the phone. In general, if you get any kind of suspicious phone call, don't give the caller any information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.