Loading

Get 2014 Wcwt-6 - Wilmingtonde

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 WCWT-6 - Wilmingtonde online

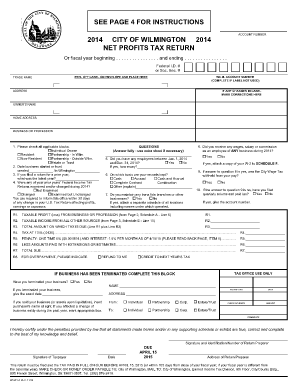

Filling out the 2014 WCWT-6 - Wilmingtonde form is an essential process for individuals and businesses in Wilmington to report their net profits tax. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the form online effectively.

- Click 'Get Form' button to obtain the form and access it in the editor.

- Start by entering your account number at the top of the form. If you received a pre-printed label, you can peel it off and place it in the designated area.

- Fill out your trade name, address, and, if applicable, correct any information on the label. Provide the owner's name and home address next.

- Indicate the type of ownership by checking all relevant boxes: individual owner, partnership, estate, or trust, and specify residency status.

- Next, fill in the date when the business started or when the trust was created. Also, note the latest year for which a return was filed if applicable.

- If any previous federal income tax returns were examined or changed, select the appropriate option.

- Answer the employment questions, including whether you had employees in the specified timeframe and specify the number if applicable.

- Select the basis on which your records are kept: cash, accrual, or another option, and provide details if necessary.

- If your business operates multiple locations, submit a schedule with all locations and any names used.

- Provide information about any wages, salary, or commissions received during the year, and check if city wage tax was withheld.

- Calculate your taxable profit (loss) from your business or profession, and fill in the necessary figures in the designated lines.

- Complete calculations for your total amount on which tax is due, including penalties if applicable, and the amount you owe or any overpayment details.

- If your business has been terminated, mark yes and provide the termination date and purchaser's name if applicable.

- Sign and date the form to certify that all information is correct to the best of your knowledge.

- Finally, save your changes, download a copy for your records, print the completed form, or share it as required.

Complete your 2014 WCWT-6 - Wilmingtonde form online to ensure timely and accurate filing.

A. Every domestic or foreign corporation doing business in Delaware, not specifically exempt under Section 1902(b), Title 30, Delaware Code, is required to file a corporate income tax return (Form 1100 or Form 1100EZ) regardless of the amount, if any, of its gross income or its taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.