Loading

Get Dr 1106 Colorado Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr 1106 Colorado Form online

Filing the Dr 1106 Colorado Form is essential for reporting state 1099 withholding taxes accurately. This guide will help you understand each section of the form and provide clear instructions on completing it online.

Follow the steps to complete the Dr 1106 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the 'Last Name or Business Name' field. Enter your name or your business name as applicable.

- Enter your 'First Name' and 'Middle Initial' in the corresponding fields.

- Fill in your 'Account Number' and 'Period' by indicating the start and end dates in MM/YY format.

- Complete the 'SSN 1' and 'SSN 2' fields with your social security numbers as required.

- Provide the 'Due Date' of the form in MM/DD/YY format.

- Specify the 'Number of 1099s Attached' to the form.

- Enter your 'FEIN' in the designated field.

- Include your 'Phone Number' for any necessary follow-ups.

- If applicable, mark the box indicating that this is an amended return.

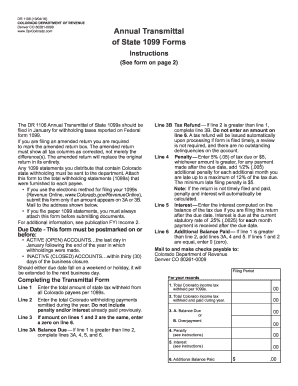

- For line 1, enter the total amount of state tax withheld from all Colorado payees per the 1099s.

- On line 2, record the total Colorado withholding payments remitted during the year, excluding any penalties or interest already paid.

- If the amounts on lines 1 and 2 are the same, enter zero on line 6.

- Complete line 3A if line 1 exceeds line 2. Enter the difference and then continue to lines 4, 5, and 6 as instructed.

- If line 2 exceeds line 1, complete line 3B. No amount should be entered on line 6.

- Fill out lines 4 and 5 as required for penalties and interest based on the instructions provided.

- Finally, gather all attached documents and proceed to save your changes, download, print, or share the finished form as necessary.

Complete and file your Dr 1106 Colorado Form online today to ensure your state tax withholdings are reported accurately.

Withholding Formula (Effective Pay Period 05, 2021) Multiply the adjusted gross biweekly wages by the number of pay dates in the tax year to obtain the gross annual wages. Multiply the taxable wages in step 5 by 4.55 percent to determine the annual tax amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.