Loading

Get Ac934p

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ac934p online

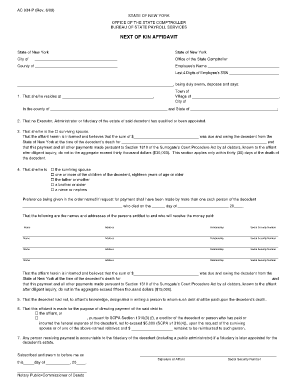

Filling out the Ac934p, also known as the Next of Kin Affidavit, can be straightforward with the right guidance. This document is essential for directing payment due to a decedent in the State of New York and must be completed carefully to ensure compliance with legal requirements.

Follow the steps to fill out the Ac934p online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the decedent's information, including their name and the last four digits of their Social Security Number. Make sure this information is accurate to avoid delays.

- Next, provide the residence details of the affiant, which includes the complete address in the designated fields.

- Indicate the relationship of the affiant to the decedent by selecting the appropriate checkbox. Each option provided (surviving spouse, child, parent, etc.) must align with your legal connection to the decedent.

- Fill in the amount believed to be owed to the decedent and specify the reason for this amount. Ensure that the total does not exceed the limits specified in the affidavit.

- List the names, addresses, relationships, and Social Security Numbers of any others entitled to receive payments from the estate, ensuring all entries are complete and truthful.

- Complete the section regarding any written designations made by the decedent for payment upon their death, noting if none exist.

- Select the checkbox indicating to whom the payment should be directed, either the affiant or another specified individual, including any related details.

- Lastly, check all entries for accuracy, sign the affidavit, and ensure it is duly notarized to finalize the document.

- Once finished, you can save changes, download, print, or share the completed form as needed.

Complete your Ac934p online today to ensure accurate processing of the necessary payments.

Children born after the Decedent dies will inherit. Grandchildren will inherit only if their parent (the Decedent's child) dies before the Decedent died....When There Is No Will. If the Decedent has...thena spouse (husband or wife) and no childrenthe spouse inherits everythingchildren* but no spousechildren inherit everything4 more rows • 11 Oct 2018

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.