Loading

Get 2014 Ip-030 Form 3 Wisconsin Partnershp Return - Revenue Wi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 IP-030 Form 3 Wisconsin Partnership Return - Revenue Wi online

Filling out the 2014 IP-030 Form 3 Wisconsin Partnership Return - Revenue Wi online can seem daunting, but with the right guidance, the process can be straightforward and manageable. This guide aims to provide clear, detailed instructions for successfully completing each section of the form to ensure accurate filing.

Follow the steps to complete the form efficiently.

- Click ‘Get Form’ button to access the document and open it for editing.

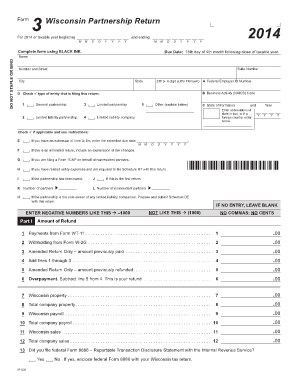

- Enter the name, suite number, street address, city, state, and ZIP code of the partnership at the top of the form. Ensure all entries are accurate to prevent any processing issues.

- Provide the Federal Employer Identification Number and the Business Activity (NAICS) Code to identify the partnership's activities.

- Check the appropriate box to indicate the type of entity filing the return, such as general partnership, limited liability partnership, limited partnership, or other.

- State the year of formation and enter the abbreviation of the state or the name of the foreign country in the corresponding box.

- If applicable, indicate if you have an extension of time to file by filling in the extended due date. If this is an amended return, provide an explanation of the changes made.

- Fill out the number of partners and the number of nonresident partners.

- In Part I, fill in the appropriate financial information, such as payments from Form WT-11 and withholding amounts from Form W-2G.

- Continue to complete the calculations as directed, ensuring no commas or cents are used, and negative numbers are formatted correctly.

- In Part II, provide the details of the partners' distributive share items as required, including ordinary business income, deductions, and any relevant attachments.

- Make sure to sign the form in the designated area and provide the contact information of the person responsible for the return.

- Finally, save your changes, and opt to download, print, or share the completed form for submission.

Complete your documents online with confidence and ensure timely submissions to the Wisconsin Department of Revenue.

There is a $50 fee for filing a Wisconsin income tax return late. The state can also assess a negligence penalty for failing to file on time. This is 5% of the tax due per month, and it can get up to 25%. Wisconsin charges a delinquent collection fee of 6.5% of the taxes due, with a minimum fee of $35.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.