Loading

Get Qualifying Trust Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Qualifying Trust Template online

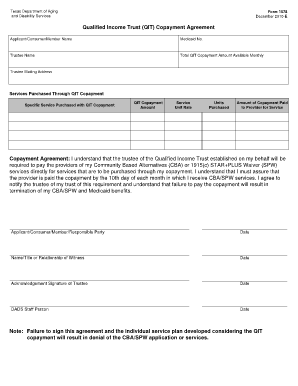

Filling out the Qualifying Trust Template online is a vital step in managing your Qualified Income Trust copayment agreements. This guide provides step-by-step instructions to help you efficiently complete the form and ensure compliance with necessary regulations.

Follow the steps to complete the Qualifying Trust Template online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the applicant or consumer's full name in the designated field, which identifies the individual relying on the trust.

- Input the Medicaid number associated with the applicant to establish proper identification within the system.

- Provide the name of the trustee responsible for managing the Qualified Income Trust.

- Indicate the total monthly copayment amount available from the trust in the designated field.

- Fill in the trustee's mailing address to ensure proper communication regarding the trust.

- List the services purchased through the QIT copayment, specifying each service in detail.

- For each service, indicate the QIT copayment amount, service unit rate, units purchased, and the total amount paid to the provider for the service.

- Acknowledge the terms of the copayment agreement by confirming your understanding of the responsibilities regarding timely payments.

- Fill in the date of agreement along with the name, title, or relationship of the witness.

- Ensure the trustee acknowledges the agreement by signing and dating the document.

- Record the date for the DADS staff person's acknowledgment signature.

- Once all fields are completed, save your changes, then download, print, or share the form as required.

Complete your documents online today to ensure compliance and streamline your processes.

The QIT is not to be confused with other types of trusts such as a special needs trust, living trust or Medicaid qualifying trust. ... The trust must be irrevocable. In other words, the trust cannot be changed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.