Loading

Get Recommended Record Retention Periods For ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RECOMMENDED RECORD RETENTION PERIODS FOR business records online

This guide provides a comprehensive overview of how to fill out the RECOMMENDED RECORD RETENTION PERIODS FOR business records form online. It breaks down each section and field to ensure you understand how to properly complete the process and manage your records efficiently.

Follow the steps to fill out the form accurately.

- Click the 'Get Form' button to obtain the form and open it in the editor. This will allow you to access the necessary fields for completion.

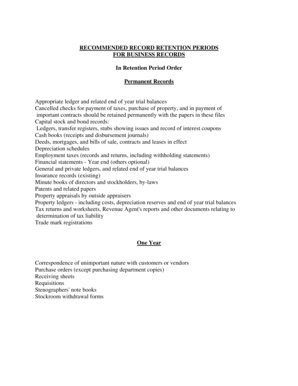

- Begin by reviewing the sections for permanent records, which include important documents that must be retained indefinitely. Make a list of items that fall under this category as you fill out the form.

- Next, follow through the retention periods outlined for one year, three years, four years, and seven years. Clearly identify which of your records fit into these categories.

- Accurately fill in the required fields associated with each record type, such as titles, dates, and retention explanations.

- Once you have completed filling out the form, double-check all entries for accuracy and completeness.

- Finally, you can save changes and either download, print, or share the form as per your requirements.

Complete your document management effectively by filing your records online today.

Legal Documents For example, documents such as bills of sale, permits, licenses, contracts, deeds and titles, mortgages, and stock and bond records should be kept permanently. However, canceled leases and notes receivable can be kept for 10 years after cancellation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.