Loading

Get Instructions For Submitting Forms 1099 And W-2g Tax Year 2014 - Maine

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For Submitting Forms 1099 And W-2G Tax Year 2014 - Maine online

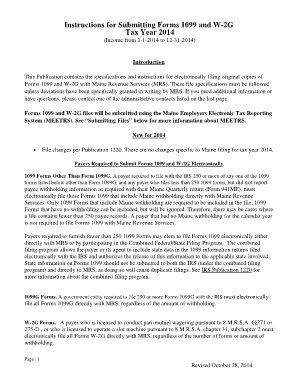

This guide provides a clear and supportive pathway for users to fill out the Instructions for Submitting Forms 1099 and W-2G for tax year 2014 in Maine. It outlines essential steps and components, ensuring a seamless electronic filing experience.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to access the form.

- Review the due dates: Ensure your electronic submission is completed by March 31, 2015, as Maine does not accept paper or magnetic media submissions.

- Identify your payer status: Determine if you are required to submit Forms 1099 or W-2G electronically based on the number of forms and withholding information.

- Fill out the T record: This includes entering the payment year as 2014 and providing the transmitter's TIN, name, and contact information as per specifications.

- Complete the A record: Input the payer's TIN, name control, and ensure the filing type is correct, following the specific column guidelines.

- Populate the B record with necessary payee information, including TINs and payment amounts. Ensure to enter zeros for unused payment amounts.

- Finalize the F record: Provide totals for the number of A records submitted and total Maine withholding reported.

- Perform a review: Validate all entries and ensure that no prior year forms are included, as only 2014 data is acceptable for submission.

- Submit the completed file electronically via the Maine Employers Electronic Tax Reporting System (MEETRS). Upon successful submission, save the confirmation number for your records.

Ensure to complete your filing accurately and on time. Start filling out your forms online now!

According to the IRS, most corrected forms must be filed by April 2, 2020 because March 31, 2020 falls on a Sunday. However, Form 1099-MISC on paper or electronically must be filed by January 31, 2020, if you are reporting Nonemployee compensation in box 7..

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.