Loading

Get Summary Of Issues For Affiliated Organizations

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SUMMARY OF ISSUES FOR AFFILIATED ORGANIZATIONS online

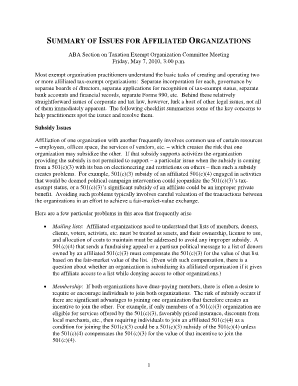

Filling out the SUMMARY OF ISSUES FOR AFFILIATED ORGANIZATIONS is an essential task for practitioners managing multiple tax-exempt entities. This guide offers step-by-step instructions to help users efficiently complete the form online with confidence.

Follow the steps to complete the form accurately and effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by entering the identifying information for each affiliated organization involved. Ensure that the names, addresses, and tax identification numbers are accurate to avoid any processing delays.

- Proceed to describe the nature of the affiliation between the organizations. Clearly outline how resources are shared among them, particularly focusing on employees, funding, and services offered.

- Address any subsidy issues. Specifically, evaluate if one organization is providing benefits that could jeopardize the tax-exempt status of another. Provide fair-market valuation for any shared resources or transactions.

- Detail any mailing lists, memberships, or goodwill related concerns. Specify ownership and usage rights to prevent conflicts and ensure compliance with tax laws.

- Describe attribution issues, especially pertaining to communications and media references. Highlight measures taken to avoid confusion regarding organizational endorsements.

- Cover employment issues, indicating shared employees and relevant payroll obligations. Clarify which organization fulfills payroll duties and any state obligations that may arise.

- Finalize by reviewing the information for accuracy and completeness. Once satisfied, you can save changes, download, print, or share the form as necessary.

Complete your documents online with confidence and ensure compliance with tax regulations.

Program Services Expenses – Expenses incurred by an organization while performing its tax-exempt activities. Management and General Expenses – Expenses related to the day-to-day operation of an organization. Included are items such as personnel, accounting, and legal services, general insurance, and office management.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.