Loading

Get Application For Exemption Sharing Ministry - Health Insurance ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Exemption Sharing Ministry - Health Insurance online

This guide provides a clear and supportive overview of how to successfully complete the Application for Exemption Sharing Ministry - Health Insurance online. By following these step-by-step instructions, users with varying levels of experience can navigate the application process with confidence.

Follow the steps to complete your application effortlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

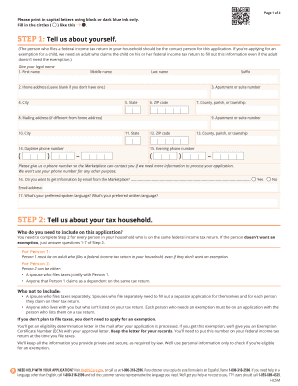

- Provide your legal name, home address, and contact information. Make sure to fill in the first name, middle name, last name, and any suffix. If available, include your daytime and evening phone numbers, along with an email address if you wish to receive information via email.

- Complete details about your tax household. This involves identifying who is included in the application based on your federal income tax return. Fill in the same information for each person listed.

- For each person in your household, provide their legal name, date of birth, Social Security Number (if available), and indicate their relationship to you. Confirm if they plan to file a federal income tax return and whether they wish to apply for an exemption.

- Provide information about the health care sharing ministry of which you are a member. Include the organization’s name, address, and any relevant dates of membership.

- Fill in optional demographic information, such as ethnicity and race, if you wish. This section helps with the collection of statistical data.

- After completing all necessary sections, carefully read through the application to ensure all information is accurate. Sign and date the application, confirming your agreement to the statements provided.

- Mail your completed application to the specified address for processing. Ensure that you keep a copy of the application for your records.

- After submitting your application, wait for a follow-up from the Health Insurance Marketplace regarding your eligibility. You will receive an Exemption Certificate Number (ECN) if approved.

Complete your application for exemption online today to ensure your health insurance needs are met.

In general, you may be eligible for tax credits to lower your premium if you are single and your annual 2020 income is between $12,490 to $49,960 or if your household income is between $21,330 to $85,320 for a family of three (the lower income limits are higher in states that expanded Medicaid).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.