Loading

Get Instructions For The Annual Withholding Reconciliation Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For The Annual Withholding Reconciliation Statement online

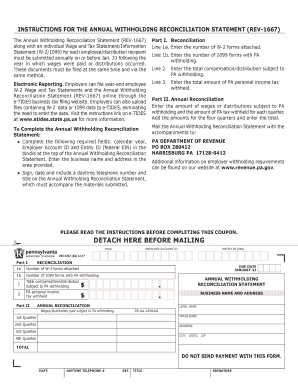

The Annual Withholding Reconciliation Statement (REV-1667) is a crucial document for employers to submit annually. This guide provides clear and user-friendly steps to fill out the form online, ensuring you meet all requirements efficiently.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In the top section of the form, complete the required fields: enter the calendar year, your Employer Account ID, and the Entity ID (federal EIN). This information is essential for proper identification.

- Next, provide your business name and address in the designated area. Ensure that this information is accurate to avoid any complications.

- For Part I, Reconciliation, enter the number of W-2 forms attached to your filing in Line 1a, and the number of 1099 forms with PA withholding in Line 1b.

- In Line 2, specify the total compensation or distribution amounts that are subject to PA withholding.

- In Line 3, you will enter the total PA personal income tax that has been withheld during the year.

- Proceed to Part II, Annual Reconciliation, where you will need to enter the amounts of wages or distributions subject to PA withholding for each of the four quarters. Make sure to sum these amounts correctly.

- After completing the required sections, you must sign and date the form. Include a daytime telephone number and title at the bottom.

- Finally, you may choose to save any changes made to the form, download it, print a copy for your records, or share it as needed.

Start preparing your Annual Withholding Reconciliation Statement online now to ensure timely submission.

Mail the W-2 Transmittal with the accompaniments to: PA Department of Revenue, PO BOX 280412, Harrisburg, PA 17128-0412.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.