Loading

Get Request For Taxpayer Relief: Cancel Or Waive ... - Cch Site Builder

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Request For Taxpayer Relief: Cancel Or Waive ... - CCH Site Builder online

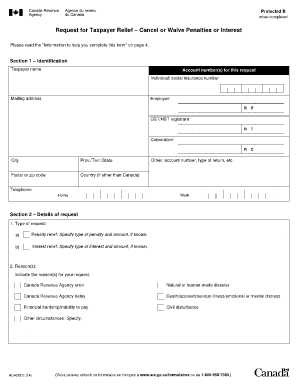

Filling out the Request For Taxpayer Relief: Cancel Or Waive form can be essential for individuals seeking relief from penalties or interest imposed by the Canada Revenue Agency. This guide will provide you with user-friendly, step-by-step instructions to help ensure you complete the form accurately and effectively.

Follow the steps to complete the form with ease.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- In Section 1, provide your identification details. This includes your name, account number(s), mailing address, and contact information. Ensure accuracy in your social insurance number and indicate if you are a GST/HST registrant or part of another employment type.

- Move to Section 2, where you will detail your request. Select the type of relief you are seeking — either penalty relief or interest relief — and specify the amounts if known.

- Indicate the reason(s) for your request in Section 2. This could range from errors made by the Canada Revenue Agency to circumstances such as financial hardship or natural disasters.

- List the specific year(s) or period(s) involved with your tax situation as requested in Section 2. Be sure to clarify the taxation year(s) or pay period(s) that apply.

- If this is a request for a second review, confirm this and provide the required details about your disagreement with the previous decision. Otherwise, proceed to write any information that supports your initial request.

- In Section 3, submit all relevant supporting documentation as evidence for your request, as specified in the instructions.

- Complete Section 4 by certifying your request. If applicable, enter the representative’s details and include their authorization number.

- Once all sections are complete, review your form for accuracy. Save the changes, then choose the options to download, print, or share the form as required.

Start filling out your Request For Taxpayer Relief form online today!

RC240 Designation of an Exempt Contribution - Tax-Free Savings Account (TFSA)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.