Loading

Get Iowa 1041

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iowa 1041 online

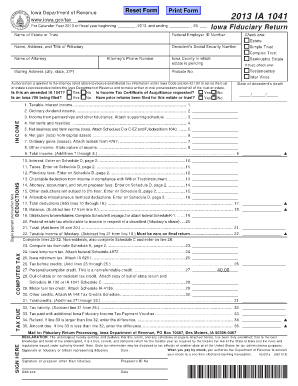

Filling out the Iowa 1041 form, which serves as the Fiduciary Return for estates and trusts, can seem daunting. This guide provides clear and supportive instructions to help users complete the form accurately and efficiently online.

Follow the steps to successfully complete the Iowa 1041 form.

- Click ‘Get Form’ button to access the Iowa 1041 and open it for editing.

- Begin by entering the name of the estate or trust at the top of the form, along with the Federal Employer ID Number.

- Provide the name, address, and title of the fiduciary responsible for the estate or trust. Additionally, input the decedent’s Social Security Number.

- Indicate the type of entity by checking the appropriate box for Estate, Simple Trust, or Complex Trust.

- Fill in the name and contact information of the attorney representing the estate or trust.

- Specify the Iowa County where the estate is pending and include details about bankruptcy estates, if applicable.

- Answer the questions regarding whether the form is amended, if an Iowa 706 is being filed, and if an Income Tax Certificate of Acquittance is requested.

- Enter the date of the decedent’s death.

- Complete the income section by entering amounts for taxable interest, ordinary dividends, income from partnerships, net rents and royalties, business income, capital gains or losses, and other income.

- Calculate total income by adding all income sources and enter the total in the provided field.

- In the deductions section, enter amounts for interest, taxes, fiduciary fees, attorney fees, and other allowable deductions.

- Compute total deductions and subtract this total from the total income to determine the balance.

- Complete the distributions to beneficiaries section, ensuring to attach necessary schedules or federal Schedule K-1.

- Calculate taxable income by subtracting the total distributions and federal estate tax attributable from the balance determined earlier.

- Using the provided tax rates from the form, compute the total tax due based on the taxable income.

- Fill in any applicable credits and calculate the final tax liability. Ensure to document any tax paid and potential refund amounts.

- Once all fields are complete, review the form for accuracy, then save your changes, and choose to download, print, or share the completed form as necessary.

Start filling out your Iowa 1041 online today to ensure timely and accurate submission.

Iowa Residents are required to pay income tax on all of their income regardless of where it was earned. If another state also taxes the income, you may be able to claim a credit for taxes paid to the other state on your return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.