Loading

Get Rev 1736

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rev 1736 online

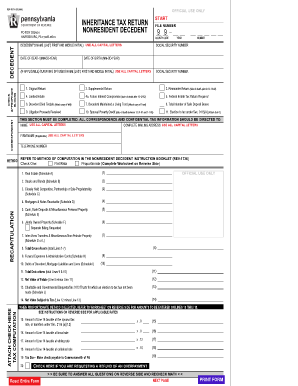

The Rev 1736 form is a critical document used for filing inheritance tax returns for nonresident decedents. This guide provides a step-by-step approach to assist users in accurately completing the online version of the form, ensuring compliance and clarity throughout the process.

Follow the steps to complete the Rev 1736 online efficiently.

- Click the ‘Get Form’ button to access the Rev 1736 and open it in the editor.

- Begin by filling in the 'Correspondent' section. Enter your name in capital letters along with the complete mailing address and telephone number. If applicable, include the firm name also in capital letters.

- Continue to the 'County Code' and 'Date of Death' sections. Enter the relevant county code and the date of death in the specified format (MM-DD-YEAR).

- In the section regarding the surviving spouse, provide their name in all capital letters if applicable. Enter their social security number in the corresponding field.

- Select the appropriate option for the type of return you are filing—choose between Original, Supplemental, or Remainder Return, among others.

- Complete the 'Method of Computation' section by selecting either Flat Rate or Proportionate, and follow further instructions provided in the accompanying documentation.

- Proceed to list assets in the appropriate schedules provided in the form, including real estate, stocks, bonds, and personal property. Ensure that each entry is accurately listed and categorized.

- Calculate total deductions, including any funeral expenses, administrative costs, debts, and then derive the net value of the estate by subtracting total deductions from total gross assets.

- Fill in details regarding charitable bequests or any special trusts that have not been elected for tax consideration.

- Before submission, review each entry for accuracy. Save your changes, and ensure to download, print, or share the completed form according to your filing needs.

Complete the Rev 1736 online today to ensure proper filing of your inheritance tax return.

Examples of proof of purchase include: a credit or debit card statement. a lay-by agreement. a receipt or reference number (for phone or internet payments) a warranty card showing the supplier's or manufacturer's details, date and amount of the purchase.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.