Loading

Get Nol Carryforward Schedule

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nol Carryforward Schedule online

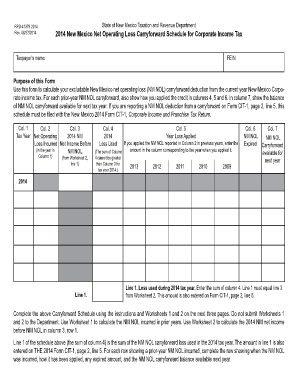

This guide provides a step-by-step approach to completing the Nol Carryforward Schedule online for the 2014 New Mexico Corporate Income Tax. Utilizing this form correctly ensures that users can accurately calculate and report their net operating loss carryforward deductions.

Follow the steps to effectively fill out the Nol Carryforward Schedule.

- Click 'Get Form' button to acquire the Nol Carryforward Schedule and open it in the online editor.

- In the first section, enter the taxpayer's name and the Federal Employer Identification Number (FEIN) in the designated fields.

- In column 1, input the tax year for which the net operating loss was incurred. For the current schedule, enter '2014'. Subsequent rows should be used for losses incurred in prior years.

- Column 2 requires you to enter the amount of net operating loss (NOL) incurred in the specified tax year documented in column 1.

- In column 3, provide the 2014 New Mexico net income before any NOL carryforward is applied. This amount is derived from Worksheet 2, line 1, and must be accurately reflected.

- Column 4 should contain the portion of the NOL that was used during the 2014 tax year. Ensure that the total of column 4 does not exceed the value in column 3.

- In column 5, specify the year(s) during which the NOL from column 2 was applied. Indicate the corresponding amounts for the respective years.

- Column 6 is for entering the amount of NOL that expired in the current tax year. This is critical as it cannot be carried forward indefinitely.

- Finally, in column 7, calculate the carryforward of NOL that will be available for the next year by subtracting the amounts in columns 4 through 6 from the amount in column 2.

- Once all fields are completed, review the form for accuracy. Users can then save their changes, download, print, or share the form as needed.

Start completing your Nol Carryforward Schedule online today.

A taxpayer must carry an NOL to the earliest tax years to which it can be carried back or carried over. If the NOL is not fully absorbed in the carryback or carryover year, the taxpayer must then carry it over to the next earliest tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.