Loading

Get Cr-h - Co Scott Mn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CR-H - Co Scott Mn online

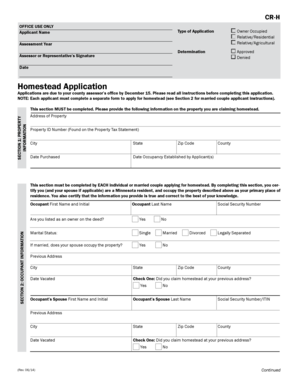

Filling out the CR-H form for homestead applications in Scott County, Minnesota can be straightforward if you follow the right steps. This guide provides clear instructions to help you complete the form efficiently and accurately.

Follow the steps to complete your CR-H application online.

- Click 'Get Form' button to obtain the form and open it in your preferred document editor.

- In Section 1: Property Information, enter the address of the property you are claiming as homestead. Include the Property ID Number found on your property tax statement, and fill in the city, state, and zip code. Make sure to provide the date you purchased the property and the date when occupancy was established.

- Section 2: Occupant Information requires the names of the occupants and their marital status. Indicate whether you are listed as an owner on the deed and provide your Social Security Number. Also, report your previous address and if you claimed homestead there.

- In Section 3, you will select either Section 3A for Residential Homestead or Section 3B for Agricultural Homestead. Answer the eligibility questions under the section relevant to your claim.

- If you are a qualifying relative, complete Section 4: Relative Homestead Application. Provide the property owner's name, relationship to the applicant, and confirm whether they are a Minnesota resident.

- Lastly, Section 5: Signature requires signatures from all owners who occupy the property. Ensure all information is verified for accuracy before signing and dating the application.

- Once all sections are complete, save your changes and proceed to either print, download, or share the form as needed.

Complete your application online today to ensure you meet the necessary deadlines for homestead classification.

The homestead market value exclusion provides a tax reduction to all homesteads valued below $413,800 by shifting a portion of the tax burden that would otherwise fall on the homestead to other types of property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.