Loading

Get T1236

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T1236 online

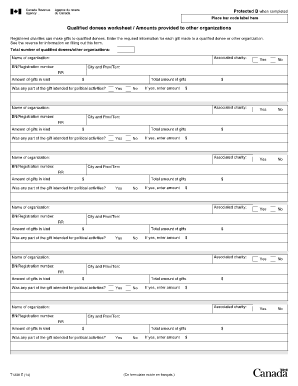

The T1236 form is essential for registered charities to document the gifts made to qualified donees and other organizations. This guide will provide you with step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out the T1236 with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the total number of qualified donees or other organizations that received gifts from your charity. This number will be crucial for your records.

- For each organization, provide the full name of the organization that received the gift. Ensure that you do not list any organization more than once.

- Indicate whether the organization is associated with your charity by ticking 'Yes' or 'No'. Associated charities have a specific designation from the Charities Directorate.

- Input the organization's complete business number (BN) if they have one. This number is assigned to organizations with accounts at the Canada Revenue Agency.

- Enter the city and province or territory where the organization is located. If the organization is international, include the full address, including the country.

- Detail the amount of gifts in kind you provided to the organization, ensuring amounts are expressed in Canadian dollars. Gifts in kind refer to non-cash gifts such as tangible property.

- Record the total amount of all gifts given to the organization, which includes both cash and gifts in kind. Again, ensure this amount is in Canadian dollars.

- Specify if any part of the gift was intended for political activities. If applicable, indicate the amount and clarify that this reflects the charity’s intent, not how the recipient will use the funds.

- Once all information is accurately filled in, review for any errors. You can then save changes, download, print, or share the completed T1236 form as needed.

Complete your T1236 form online to ensure your charity’s compliance and support your initiatives effectively.

Related links form

Qualified charitable organizations include charities, philanthropic groups, certain religious and educational organizations, nonprofit veterans' organizations, fraternal lodge groups, and cemetery and burial companies. Certain legal corporations can also qualify.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.