Get How To Complete A Sba For Borrowers Consent To Verify Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Complete A Sba For Borrowers Consent To Verify Form online

This guide provides clear and concise instructions on how to fill out the How To Complete A Sba For Borrowers Consent To Verify Form online. Follow the steps carefully to ensure accurate completion for your SBA loan process.

Follow the steps to complete the form online successfully.

- Click ‘Get Form’ button to access the form and open it in your chosen editor.

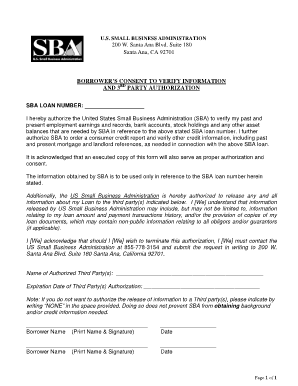

- Locate the SBA loan number field and enter your specific loan number.

- In the authorization section, confirm your consent for the SBA to verify your past and present employment earnings, records, and other financial information required for your loan.

- Fill in the name of the authorized third party who may receive details about your loan.

- Provide the expiration date for the third party's authorization.

- If you do not wish to authorize the release of information to any third parties, write 'NONE' in the designated space.

- Sign and print your name in the borrower name section, ensuring clarity.

- Include the date of signature.

- If there is a co-borrower, repeat the previous two steps for the second borrower's name, signature, and date.

- Once the form is completed, save your changes, and prepare to download, print, or share the document as needed.

Complete your forms online to streamline your SBA loan verification process.

The SBA promises a turnaround time of 36 hours for their express loans. But, that doesn't include the time it takes for the lender to approve the loan, which could tack on another few weeks. So, instead of 60-90 days, you're looking at 30-60 days for the SBA loan processing time when all is said and done.

Fill How To Complete A Sba For Borrowers Consent To Verify Form

Use our guide to learn how to fill out this form. Summary: An SBIC uses this form to provide SBA with the information required to monitor and examine the SBIC from both a financial and regulatory perspective. The SBA 7(a) Draft Authorization process typically takes 7-10 business days.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.