Loading

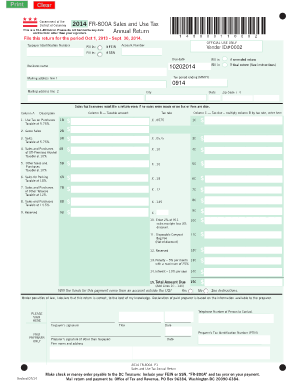

Get Fr-800a 2014 Sales And Use Tax Annual Return Fill-in Version - Otr - Otr Cfo Dc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FR-800A 2014 Sales And Use Tax Annual Return Fill-in Version - Otr - Otr Cfo Dc online

Filing your FR-800A 2014 Sales And Use Tax Annual Return can be straightforward with the right guidance. This document will provide you with a detailed, step-by-step approach to filling out the form online, ensuring that all necessary fields are completed accurately.

Follow the steps to correctly complete your online FR-800A form.

- Click ‘Get Form’ button to obtain the form and open it in an editable format.

- Begin by entering your taxpayer identification number in the designated field. This could be your FEIN or SSN, depending on your business structure.

- Fill in your business name as it appears on your tax documents. Ensure this is accurate to avoid potential issues.

- Provide your mailing address, including street address, city, state, and ZIP code. Use the second line for any additional address information.

- Indicate the due date for your return by filling in the appropriate date next to 'Due date.' This form is for the period ending September 30, 2014.

- In the sales and purchases section, input the taxable amounts corresponding to various categories, such as sales tax from purchases and gross sales.

- Calculate the tax due for each category by multiplying the taxable amount by the applicable tax rate and enter these figures in Column C.

- Make sure to review any reserved lines to confirm they are filled out accordingly, following the guidelines provided for each.

- After completing the tax calculation, ensure you add up all the amounts in Column C for your total amount due.

- Read and sign the declaration statement at the end of the form, ensuring to include your contact number. If you are using a paid preparer, make sure they fill in their information as required.

- Once all fields are accurately filled out, finalize your form by saving changes, downloading, printing, or sharing it as necessary.

Take action today and complete your FR-800A form online for a smoother filing experience.

imposition of sales tax: A person doing business in the District must collect District sales tax from the pur- chaser on: . Sales of tangible personal property delivered to a customer in the District; 2. Certain services; 3. Renting or leasing of tangible personal property used in the District; 4.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.