Loading

Get Cert-106, Claim For Refund Of Use Tax Paid On A Motor ... - Ct.gov - Ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CERT-106, Claim For Refund Of Use Tax Paid On A Motor Vehicle online

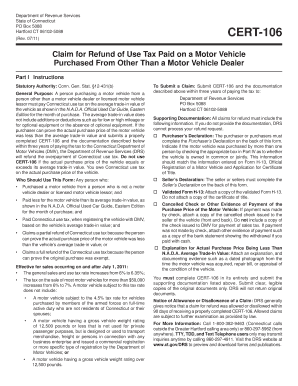

Filing the CERT-106 form allows individuals to claim a refund for overpaid use tax on motor vehicles purchased from sources other than licensed dealers. This guide provides clear, step-by-step instructions to ensure that your application is completed accurately and efficiently.

Follow the steps to complete your CERT-106 form successfully.

- Press the 'Get Form' button to access the CERT-106 form and open it in your PDF editor.

- Begin by providing the purchaser's information in Part II. Include your full name, social security number, and address. If there are co-purchasers, have them complete their information too.

- In Part III, provide details about the motor vehicle including the make, model, year, and vehicle identification number. Also, state the date of purchase and the odometer reading at that time.

- For the refund calculation, identify the tax rate applicable based on your purchase date and value. Enter the actual purchase price and the tax paid to the Department of Motor Vehicles (DMV). Calculate the refund to claim.

- Complete the Purchaser’s Declaration in Part IV, affirming that the details provided are true. Sign and date the form. If there is co-ownership, ensure the other purchaser completes their signature and information.

- In Part V, the seller must also sign and declare the details about the sale including the purchase price. If there are additional sellers, they should provide their signatures.

- Review the form to ensure all sections are completed accurately. Make copies of the supporting documentation required, such as validated Form H-13 and evidence of payment.

- Finalize your application by saving changes, and ensure you can download, print, or share the form as necessary before submitting it.

Begin your claim process for a refund by completing the CERT-106 form online today.

Act No. 22-118 §410 (effective May 26, 2022). Personal Income Tax Credit for Property Taxes Paid. Beginning in 2022, residents that own motor vehicles or homes in Connecticut will receive a property tax credit of up to $300, which is increased from the prior credit of $200.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.