Loading

Get And Enclose Any Applicable Fees - Transportation Wv

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AND ENCLOSE ANY APPLICABLE FEES - Transportation Wv online

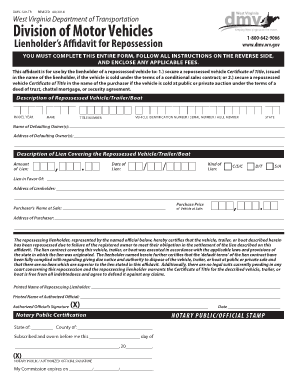

Filling out the AND ENCLOSE ANY APPLICABLE FEES - Transportation Wv is crucial for lienholders of repossessed vehicles. This guide will walk you through each section of the form step by step to ensure you understand the requirements and complete it accurately.

Follow the steps to easily complete the submission process.

- Press the ‘Get Form’ button to access the document and open it in your preferred editor.

- Begin by entering the details of the repossessed vehicle. Include the model year, make, Vehicle Identification Number (VIN) or serial number, hull number if applicable, and the title number in the provided fields.

- Fill in the name and address of the defaulting owner(s) accurately to ensure proper communication throughout the process.

- Provide information about the lien covering the repossessed vehicle, including the amount and date of the lien. Choose the appropriate kind of lien from the options available (conditional sales contract, deed of trust, security agreement).

- Include the name and address of the lienholder, ensuring that all entered data is correct as it will be used in the official documentation.

- Certify the repossession by having the official representative from the lienholder's side sign and print their name in the designated area. The signature must be completed by an authorized official.

- Complete the notary public certification section. This involves signing in front of a notary, who will also sign and stamp the document confirming the authenticity.

- Review the entire form for any missing information or errors. Once everything is filled out accurately, you can finalize by saving the changes, downloading, printing, or sharing the form as needed.

Complete your documents online to ensure efficient processing of your repossession claims.

The minimum combined 2023 sales tax rate for Auto, West Virginia is 6%. This is the total of state, county and city sales tax rates. The West Virginia sales tax rate is currently 6%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.