Loading

Get Rp-420-a/b Rnw-ii Property Use- Addendum #1 - Nassau County - Nassaucountyny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RP-420-a/b Rnw-II Property Use- Addendum #1 - Nassau County - Nassaucountyny online

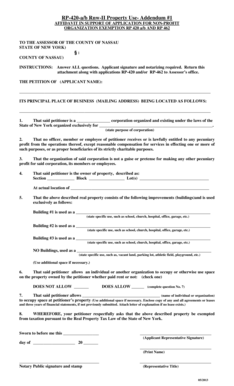

Filling out the RP-420-a/b Rnw-II Property Use- Addendum #1 is an essential step for organizations seeking property tax exemptions in Nassau County. This guide provides a straightforward, step-by-step approach to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Begin by filling in the 'Applicant Name' section, clearly stating the name of the organization applying for the exemption.

- In section 1, indicate the type of corporation and its specific purpose. This should reflect the organization's mission clearly.

- Fill out section 4 with details about the property, including the section, block, and lot numbers, along with the property's actual location.

- In section 6, check the appropriate box to indicate whether the organization allows individuals or other organizations to occupy space on the property.

- In section 8, submit a statement requesting the property exemption under the Real Property Tax Law of New York. Ensure all required signatures are included.

Ensure a smooth submission process by completing your RP-420-a/b Rnw-II Property Use- Addendum #1 form online today.

You can get help with property tax exemptions for homeowners, including: Clergy Property Tax Exemption. Crime Victim Property Tax Exemption. Disabled Homeowners' Exemption (DHE) School Tax Relief for Homeowners (STAR) Senior Citizen Homeowners' Exemption (SCHE) Veterans Property Tax Exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.