Loading

Get - Tax Ri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Ri online

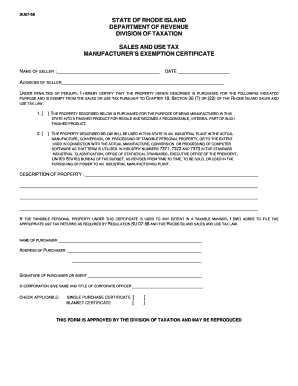

Filling out the Tax Ri form is a crucial step for individuals and organizations seeking exemption from sales and use tax in Rhode Island. This guide will provide you with clear and detailed instructions on how to complete each section of the form effectively and efficiently.

Follow the steps to complete the Tax Ri form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the name of the seller in the designated field.

- Enter the date of the transaction accurately.

- Provide the complete address of the seller in the appropriate section.

- Select the applicable purpose for the exemption by checking the corresponding box. Choose between manufacturing for resale or use in an industrial plant as specified.

- Describe the property being purchased in detail, ensuring clarity about what is being exempted.

- Complete the name of the purchaser in the provided field.

- Fill in the address of the purchaser accurately.

- Sign the form as the purchaser or their agent and include the name and title of the corporate officer if applicable.

- Indicate whether this is a single purchase certificate or a blanket certificate by checking the appropriate box.

- Review all entries for accuracy before proceeding to save your changes, download, print, or share the completed form.

Complete your documents online today!

Payment Options Tax Portal. The Tax Portal can be used to quickly and easily pay your taxes using a checking or savings account. ... MeF for Personal Income. You may elect to have your payment made based on your MeF 1040 or 1040NR filing via ACH Debit. ... ACH Credit. ... Credit Card.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.