Loading

Get Ct 706 Nt Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 706 Nt Instructions online

Filing the Ct 706 Nt Instructions online can streamline the process of reporting a nontaxable estate in Connecticut. This guide provides step-by-step instructions to help users navigate the form with confidence.

Follow the steps to complete the form accurately and efficiently.

- Press the ‘Get Form’ button to access the Ct 706 Nt Instructions and open it in your online document editor.

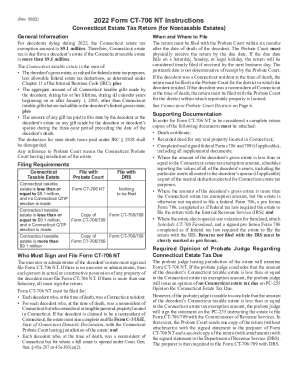

- Review the general information section carefully to understand who must file the form. Ensure you are qualified to fill out the Ct 706 Nt Instructions, particularly if the decedent's taxable estate is $3.5 million or less.

- Fill out Section 1, which encompasses general questions. It is essential to answer all questions, regardless of the decedent's residency status.

- In Section 2, you will calculate the Connecticut taxable estate. Enter the total amounts from Section 4, Line 8, and allowable deductions. Make sure to provide a comprehensive description of any deductions claimed.

- Complete Section 3 concerning property and proceeds reported for federal estate tax purposes. List the fair market values of all assets, ensuring the accuracy of ownership percentages for jointly-owned properties.

- Proceed to attach necessary supporting documentation, including a death certificate and any applicable federal Forms 706 and 709.

- Check the box if you are filing an amended return and make the required corrections as necessary.

- Sign the form at the provided location, ensuring that it is signed by the executor, administrator, or those in possession of the decedent's property.

- Once completed, save your changes, and proceed to download, print, or share the form as needed.

Start filling out your Ct 706 Nt Instructions online today to ensure a smooth filing process.

The Connecticut estate tax exemption will be $5,100,000 in 2020, $7,100,000 in 2021, $9,100,000 in 2022, and it will match the federal exemption amount on January 1, 2023. The tax rate on estates or gifts in excess of the Connecticut exemption ranges from 7.8% to 12%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.