Loading

Get Ins3977

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ins3977 online

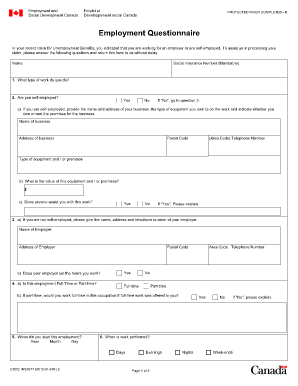

Filling out the Ins3977 form is an important step in processing your claim for unemployment benefits. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the Ins3977 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Social Insurance Number in the designated field, as this is a mandatory entry.

- In question 1, indicate the type of work you do by providing a brief description.

- If you are not self-employed, proceed to question 3 and provide your employer's name, address, and telephone number.

- Question 5 requires you to enter the date you started this employment. Ensure you complete the year, month, and day accurately.

- In question 7, specify the days of the week you usually work and state the total number of days in question 7a.

- Answer question 9 by selecting how you are paid, then provide details on any non-monetary compensation in question 10.

- Provide information in questions 12 and 13 regarding the main source of income and your job search activities.

- Finally, add your signature and the date at the end of the form to certify the accuracy of the information provided.

We encourage you to complete and submit your Ins3977 form online to ensure a smooth processing experience.

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. ... 1099 Forms. ... Bank Statements. ... Profit/Loss Statements. ... Self-Employed Pay Stubs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.