Loading

Get Notice Of Escrow Of Taxes, & Regular Monthly Payment - Com Ohio

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NOTICE OF ESCROW OF TAXES, & REGULAR MONTHLY PAYMENT - Com Ohio online

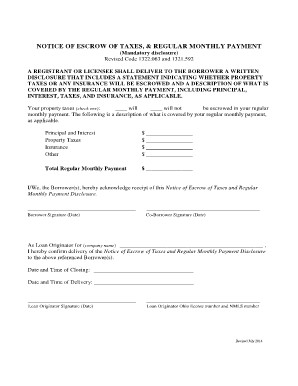

Filling out the NOTICE OF ESCROW OF TAXES, & REGULAR MONTHLY PAYMENT - Com Ohio is an essential step in managing your mortgage and understanding your financial obligations. This guide provides clear and comprehensive instructions to help you complete the form accurately online.

Follow the steps to fill out the form correctly and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate whether property taxes will be escrowed in your regular monthly payment by checking the appropriate box next to 'will' or 'will not'. This ensures clarity on tax payment responsibilities.

- In the section labeled 'The following is a description of what is covered by your regular monthly payment, as applicable', list the specific components covered. Fill in the amounts for Principal and Interest, Property Taxes, Insurance, and Other as they apply to your mortgage.

- Calculate and enter the total amount of your regular monthly payment in the designated space at the bottom of the form, ensuring accuracy in your calculations.

- Provide your signature and date in the 'Borrower Signature' section. If applicable, have your co-borrower also sign and date the form in their designated area.

- As the Loan Originator, write in your company name and sign in the specified area to confirm the delivery of the Notice of Escrow of Taxes and Regular Monthly Payment Disclosure.

- Finally, fill in the date and time of closing and delivery, and include your license number and NMLS number as required.

- After ensuring all sections are completed accurately, you can save changes, download, print, or share the form as needed.

Start filling out your documents online today for a seamless experience.

Mortgage lenders can take up to 30 days to refund escrow account balances to borrowers whose mortgage loans have been paid off. For several reasons, mortgage lenders tend to take their time refunding their borrowers' escrow accounts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.