Loading

Get Ftb 3811 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 3811 Form online

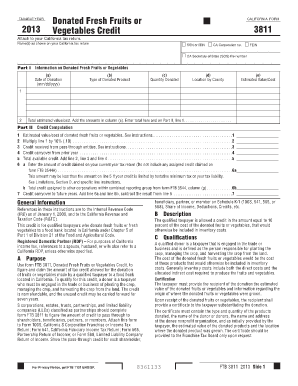

Filling out the Ftb 3811 Form online is an essential step for those looking to claim the Donated Fresh Fruits or Vegetables Credit in California. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to successfully complete the Ftb 3811 Form online.

- Click ‘Get Form’ button to access the Ftb 3811 Form and open it in your preferred editing interface.

- In Part I, enter the date of donation in the format mm/dd/yyyy, followed by the type of product donated, the quantity donated, the location by county, and the estimated value or cost.

- If additional space is required for more donations, continue using separate forms of Ftb 3811 for reporting each product and its respective information.

- Proceed to Part II and fill in the estimated value or cost of the donated items on line 1. This should reflect the value as included in inventory costs.

- Calculate 10 percent of the value from line 1, and enter this amount on line 2, representing the credit you are eligible to claim.

- If you received pass-through credits from S corporations or partnerships, total these amounts and enter them on line 3.

- If you have a carryover from the previous year’s credit, record this amount on line 4.

- Calculate the total available credit and enter this on line 5 by adding lines 2, 3, and 4.

- Fill in the amount of credit claimed on your current year tax return on line 6a, noting any limitations based on your tax situation as described in the instructions.

- If applicable, enter any assigned credit to other corporations on line 6b from form FTB 3544.

- Finally, calculate your credit carryover to future years by adding lines 6a and 6b, and subtracting the total from line 5. Enter this final amount on line 7.

- Review all entries for accuracy. Once completed, save your changes, download, print, or share the form as needed.

Start filling out your Ftb 3811 Form online today to claim your credit for donated fresh fruits or vegetables.

The MCTR payment is not taxable for California state income tax purposes. You do not need to claim the payment as income on your California income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.