Loading

Get Rrsp Over Contribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rrsp Over Contribution Form online

Filling out the Rrsp Over Contribution Form is an essential step for individuals who have made excess contributions to their registered retirement savings plans (RRSPs). This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to fill out the Rrsp Over Contribution Form online effectively.

- Press the ‘Get Form’ button to access the form and open it for editing.

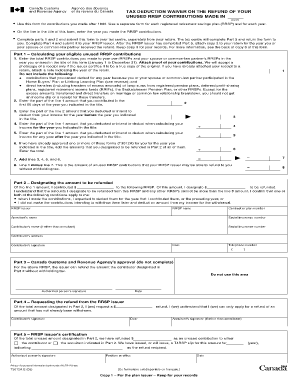

- In the title section of the form, enter the year in which you made the RRSP contributions. Make sure you select the correct year as this will determine your eligibility for the refund.

- Complete Part 1, which involves calculating your eligible unused RRSP contributions. Start by entering the total contributions made to your own and your partner's RRSPs within the specified year. Remember to attach any proof of these contributions, like certified photocopies of receipts.

- Next, specify the amount contributed within the first 60 days of the indicated year in line 2 of Part 1. This is crucial for proper deductions.

- Follow by entering the amounts you deducted or plan to deduct from your income in the relevant years across lines 3, 4, and 5. Adding these values correctly will reflect your total deductions.

- In line 6, if you have previously received approvals for any T3012A forms for the same year, sum these designated refunded amounts and input the total.

- Complete line 7 by summing lines 3, 4, 5, and 6. Subsequently, subtract this sum from line 1 to determine your unused RRSP contributions that can be refunded without withholding tax in line 8. Double-check for accuracy.

- Moving on to Part 2, designate the specific amount from line 1 that you wish to refund. Ensure that the designated refund does not exceed the amount calculated in line 8.

- Fill out the necessary identification fields, including the RRSP issuer's name, contract number, and both the contributor's and annuitant's social insurance numbers. Don’t forget your signature and date.

- In Part 4, when requested by your RRSP issuer, complete the request for the refund amount. Make sure to sign and date as well.

- Lastly, save your completed form. You may choose to download, print, or share it as needed once all sections are filled accurately.

Complete your Rrsp Over Contribution Form online today for a smoother refund process!

The penalty for RRSP over-contributions is 1 per cent per month for each month you are over the limit. CRA does allow a $2,000 grace amount for over-contributions. However, that amount is not tax deductible. The only way to remedy an RRSP contribution overpayment immediately is to withdraw the amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.