Loading

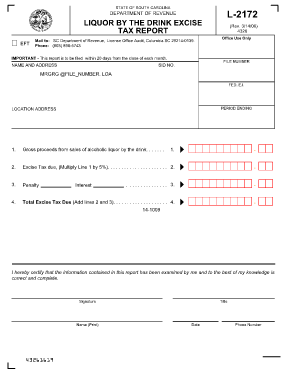

Get State Of South Carolina Department Of Revenue Liquor By The Drink Excise Tax Report Eft Mail To: Sc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE LIQUOR BY THE DRINK EXCISE TAX REPORT EFT online

This guide provides step-by-step instructions for completing the STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE LIQUOR BY THE DRINK EXCISE TAX REPORT EFT. By following these straightforward directions, you can ensure your report is filled out accurately and submitted on time.

Follow the steps to complete the liquor by the drink excise tax report.

- Press the ‘Get Form’ button to access the document and open the required form in your chosen editor.

- In the NAME AND ADDRESS section, fill in your business name and address accurately. Ensure that all details match your official records.

- Locate the FILE NUMBER and SID NO. fields. Enter the appropriate identification numbers associated with your business as required.

- For the PERIOD ENDING, specify the month for which you are filing the report. This is critical for ensuring timely processing.

- On line 1, input the gross proceeds from sales of alcoholic liquor by the drink. This amount should be the total revenue generated from these sales.

- For line 2, calculate the excise tax due by multiplying the amount from line 1 by 5%. Enter this figure in the designated space.

- Complete line 3 by calculating any penalties or interest due based on the provided guidelines. Be diligent to avoid inaccuracies.

- In line 4, sum the amounts from lines 2 and 3 to determine the total excise tax due, and enter this total in the specified field.

- Sign and print your name in the certification section, indicating you have reviewed the report for accuracy. Include your title and date, along with a contact phone number.

- Once all fields are completed, save your changes, and choose to download or print the form for your records or filing.

Complete your liquor by the drink excise tax report online to ensure compliance and timely submission.

The LCBO is one of the very few places where the price on the shelf is the price you pay - it includes the Harmonized Sales Tax (13%) and all the excise taxes (which depend on a number of factors). ... They add $0.20 for a bottle deposit and you return empties to the beer store, not the LCBO.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.