Loading

Get Form It Addback Ga

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form It Addback Ga online

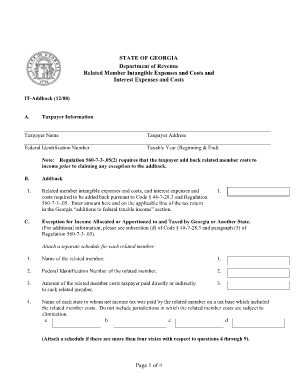

This guide provides a comprehensive walkthrough of the Form It Addback Ga, a necessary document for reporting related member intangible expenses, interest expenses, and costs in Georgia. By following these steps, users can complete the form accurately and efficiently.

Follow the steps to fill out the Form It Addback Ga with ease.

- Press the ‘Get Form’ button to obtain the form and open it in your browser.

- In the taxpayer information section, enter your name and address clearly. Also, provide your federal identification number and the taxable year for which you are filing.

- Proceed to Section C where you will need to report the related member intangible expenses and costs. Enter the amounts required by Code § 48-7-28.3 appropriately.

- For exceptions related to income allocated to Georgia or another state, provide the name and federal identification number of each related member, along with the amounts you paid to them.

- List each state where net income tax was paid by the related member and the type of tax paid in those states, entering the relevant details as requested.

- Fill in the amounts that were reported as income and the applicable apportionment ratios, ensuring all calculations follow Regulation 560-7-3-.05.

- Summarize by entering the total amounts eligible for exceptions from Section C, D, and E as instructed, and ensure that the total does not exceed the limit indicated.

- Review all information for accuracy before saving your changes, and prepare to download, print, or share the completed form.

Complete your Form It Addback Ga online today to ensure timely and accurate filing.

Rule 560-7-8-. A regular extension of time for filing for an individual and an additional extension of time for filing for a corporation granted by the Internal Revenue Service is accepted by the State of Georgia to the same due date of the Federal return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.