Loading

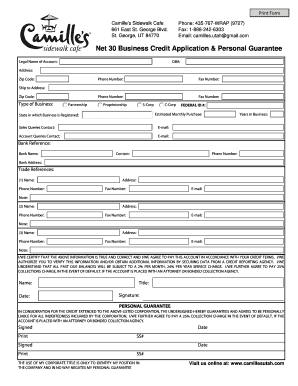

Get Business Credit Application With Personal Guarantee

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Credit Application With Personal Guarantee online

Filling out the Business Credit Application With Personal Guarantee is a crucial step in securing credit for your business. This guide will assist you in completing the form accurately and efficiently, ensuring you provide all necessary information.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin with the Legal Name of Account field. Enter the official legal name of your business as registered with your state.

- In the DBA (doing business as) field, if applicable, provide any alternate name under which your business operates.

- Fill in the Address field with your business's physical location, followed by the Zip Code.

- Provide your business's Phone Number and Fax Number in the respective fields.

- Complete the Ship to Address and corresponding Zip Code if it differs from your main address.

- Select the Type of Business from the options provided: Partnership, Proprietorship, S-Corp, or C-Corp.

- Enter your business's Federal ID number, if applicable.

- Estimate your Monthly Purchase and input that figure in the designated field.

- Indicate the State in which your business is registered.

- Fill in the Sales Queries Contact field with a name and email address for sales-related inquiries.

- Provide the Account Queries Contact information in similar fashion, ensuring a point of contact is available for account issues.

- Specify the Years in Business to give context on your operation history.

- For Bank Reference, list the Bank Name, the Contact person's name, their Phone Number, and Bank Address.

- Complete the Trade References section by providing three references with their Name, Phone Number, Address, Fax Number, Email, and any additional Notes.

- Certify the information provided by signing and dating that you agree to the terms outlined in the application.

- In the Personal Guarantee section, provide the names, signatures, and Social Security Numbers of the individuals guaranteeing the credit, along with dates.

- Review all provided information for accuracy, then save changes, download, print, or share the completed form.

Complete your Business Credit Application With Personal Guarantee online to secure the credit your business deserves.

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default. Lenders often ask for personal guarantees because they have concerns over the credit history, age or financial stability of your business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.