Loading

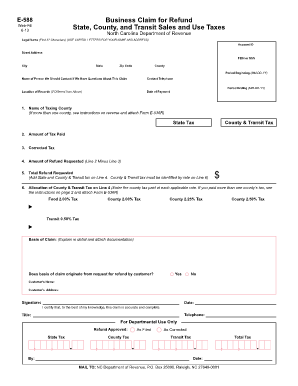

Get E588 Revised 12-03 - Nc Department Of Revenue - Dor State Nc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the E588 Revised 12-03 - NC Department Of Revenue - Dor State Nc online

Filling out the E588 form for a tax refund can seem daunting, but with the right guidance, you can complete it smoothly. This guide will help you understand each section and complete the form accurately, ensuring your claim is submitted without issues.

Follow the steps to effectively fill out the refund form online.

- Click ‘Get Form’ button to retrieve the form and open it in your preferred online editor.

- Begin by entering your legal name, ensuring to use capital letters for clarity. This should be the first 32 characters of your name.

- Input your account ID to uniquely identify your taxpayer account.

- Fill in your street address, city, state, zip code, and county accurately.

- Provide either your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) as required.

- Enter the period the claim covers, starting and ending dates in the format MM-DD-YY.

- Indicate the name of the taxing county. If more than one county is involved, refer to the instructions on the form and attach Form E-536R.

- Detail the amount of state tax and county & transit tax paid on line 2.

- On line 3, input the corrected tax amounts that should have been reported.

- Calculate the amount of refund you are requesting by subtracting the corrected tax from the total tax paid and enter this on line 4.

- On line 5, sum the amounts from line 4 to arrive at the total refund request.

- Complete line 6 by allocating the total county and transit taxes, following the proper rates.

- Provide a clear basis of your claim by explaining the reasons for the refund request and attach any supporting documentation.

- Indicate if the basis for the claim originated from a customer’s request with a simple 'yes' or 'no' and input customer details if applicable.

- Finally, sign and date the form, affirming the accuracy of your claim. Include a contact number.

- Once the form is complete, save your changes, print the document, and mail it to the provided address.

Start filling out your E588 form online today to submit your refund request!

Mailing Tips Write both the destination and return addresses clearly or print your mailing label and postage. If your tax return is postmarked by the filing date deadline, the IRS considers it on time. Mail your return in a USPS® blue collection box or at a Postal location that has a pickup time before the deadline.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.