Loading

Get Boe 501 Tf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Boe 501 Tf online

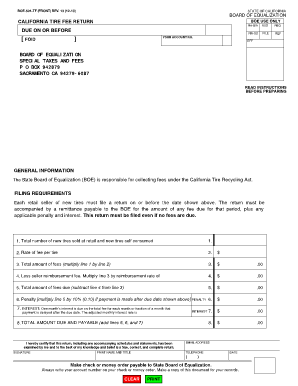

The Boe 501 Tf, officially known as the California Tire Fee Return, is a crucial document for retail sellers of new tires. This guide will assist you in completing the form online efficiently and accurately.

Follow the steps to fill out the Boe 501 Tf correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the total number of new tires sold at retail and new tires self-consumed in the appropriate field labeled '1'. Ensure that this includes tires sold to government entities.

- Input the current rate of fee per tire in field '2'. Ensure you have the most up-to-date fee rate to maintain accuracy.

- Calculate the total amount of fees by multiplying the value from step 2 by the fee rate in step 3. Enter this figure in field '3'.

- Calculate the seller reimbursement fee by multiplying the amount in field '3' by the reimbursement rate of 1.5%. Enter this amount in field '4'.

- Determine the total amount of fees due by subtracting the reimbursement amount in step 5 from the total fees in step 4. Input this total in field '5'.

- If your payment is late, calculate a penalty of 10% of the fee due in field '5' and enter it in field '6'.

- If applicable, calculate one month's interest on the total fee due for each month or fraction of a month that payment is delayed. Record this in field '7'.

- Add together fields '5', '6', and '7' to determine the total amount due. Enter this final amount in field '8'.

- Review all entries for accuracy. Once confirmed, you may save changes, download, print, or share the completed form as needed.

Complete your documents online today for a hassle-free filing experience.

Even though the state-wide base rate for California online sales tax is 7.25%, like with the rest of California's complicated tax laws as they relate to online transactions, it's not that simple. There are a few key points that every online business owner should know when it comes to California internet sales tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.