Loading

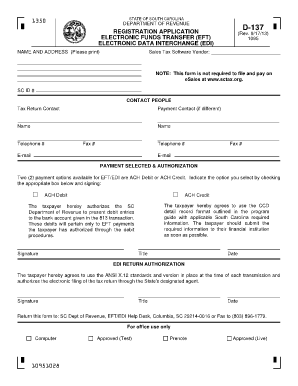

Get South Carolina Form D 137

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the South Carolina Form D 137 online

This guide provides clear instructions for filling out the South Carolina Form D 137 online, ensuring a smooth registration process for electronic funds transfer and electronic data interchange. Follow these steps to complete the form accurately and efficiently.

Follow the steps to successfully fill out the South Carolina Form D 137 online.

- Press the ‘Get Form’ button to access the form and open it in your editing tool.

- Complete the name and address section by providing the mailing address for EFT/EDI-related information.

- Fill in the 'Sales Tax Software Vendor' field with the name of the translation software you will use to file your sales tax return.

- Enter your South Carolina identification number (SC ID#). This is usually your Single Identification Number (SID), which can be found on your ST-3 or ST-388 forms.

- Provide the contact person for the tax return, ensuring their name, telephone number, fax number, and email address are accurate.

- If there is a different contact person for payment, fill out their details in the appropriate section.

- Select your payment method by checking the box for either ACH Debit or ACH Credit. Make sure to sign the application accordingly.

- If you selected ACH Credit, verify that your bank supports this payment method and inform them of the requirements.

- Provide the second signature if you are authorizing electronic filing under ANSI X.12 standards.

- Review all the information for accuracy, save your changes, and then choose to download, print, or share the form as needed.

Complete your South Carolina Form D 137 online to streamline your electronic filing process.

If you do not owe South Carolina income taxes by the tax deadline of April 18, 2023, you do not have to prepare and file a SC tax extension. In case you expect a SC tax refund, you will need to file or e-File your SC tax return in order to receive your tax refund money.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.