Get Usda Stacking Order

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Usda Stacking Order online

The Usda stacking order is a crucial document for lenders in the Guaranteed Rural Housing program. This guide will help you understand how to fill out the form correctly while ensuring that all necessary documents are submitted in the required order.

Follow the steps to complete the Usda stacking order efficiently.

- Press the ‘Get Form’ button to access and open the Usda stacking order form in your preferred online document editor.

- Enter the general information at the top of the document, including the applicants’ names, the lender's name, and the current date.

- Review the file stacking order checklist section. Ensure that you correctly identify and stack the required documents in the specified order as outlined in the checklist.

- Complete Form RD 1980-21, ensuring that all applicants and the lender sign it as required. This is essential for the loan guarantee request.

- Gather the necessary underwriting documents, including the final GUS underwriting findings and the income calculation worksheet. Make sure to prepare a comprehensive and accurate submission.

- If applicable, include any additional documentation such as verification of employment and income, asset verification documentation, and evidence of qualified alien status.

- Once all required sections and documents are completed and gathered, double-check your entries for accuracy and completeness. Save your changes to the document.

- Finally, download, print, or share the completed Usda stacking order form as required to ensure timely submission to the appropriate agency.

Start filling out your Usda stacking order online today to ensure a smooth submission process.

The United States Department of Agriculture. Unsecured loan. A loan, also known as a “note only loan,” evidenced only by the borrower's promissory note (see also “secured loan”).

Fill Usda Stacking Order

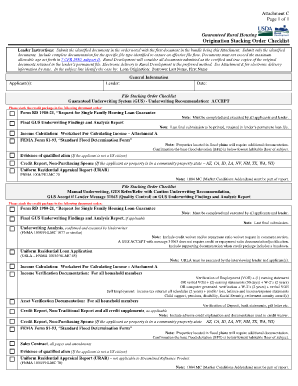

Lender Instructions: Submit the identified documents in the order noted with the first document in the bundle being this Attachment. File Stacking Order Checklist. Guaranteed Underwriting System (GUS) - Underwriting Recommendation: ACCEPT. ➢ Verify that all applicable documents are included, fully completed, signed (as needed), and readable prior to submitting to Rural Development. Lender Instructions: Submit the identified documents in the order noted with the first document in the bundle being this Attachment. Submit. The appraisal will be a separate document, but everything else listed may be stacked up and then uploaded. 18.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.