Loading

Get Charitable Organization Registration (form C-100) - Georgia ... - Sos Ga

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Charitable Organization Registration (Form C-100) - Georgia online

This guide provides a clear and comprehensive overview of the steps required to fill out the Charitable Organization Registration (Form C-100) in Georgia. By following these instructions, users will be able to navigate the form with ease and ensure that all necessary information is accurately submitted.

Follow the steps to complete the registration process:

- Press the ‘Get Form’ button to access the registration form and open it in your preferred online editor.

- Fill in the official name of your charitable organization as it appears in your legal documents. Provide the address of the applicant organization, and if your mailing address is different, include that as well.

- List any alternate names under which you plan to solicit contributions to ensure clarity in your registration.

- Designate a contact person for official correspondence. Ensure you include their telephone number and email address.

- Indicate the location where your organization maintains its books and records, ensuring that this information is accurate for legal compliance.

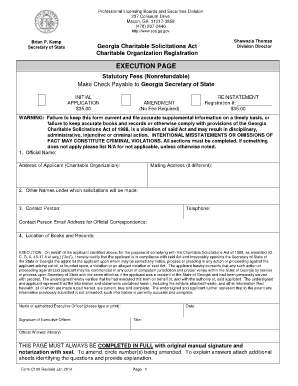

- Complete the execution section, where an authorized executive officer must certify compliance with the Georgia Charitable Solicitations Act. Ensure the signature, date, and title of the officer are included.

- Fill out the section regarding your registration status in other jurisdictions. Use '1' for pending registrations and '2' for those that are already registered.

- Provide your fiscal year-end date, date of formation, and specify your organization type (e.g., corporation, partnership, etc.).

- Attach the necessary financial information as specified, including IRS Form 990 and any required financial statements based on your organization's revenue.

- State the general purpose of your charitable organization and the specific uses for the funds solicited.

- Complete solicitation information, including the method(s) of solicitation, the period of solicitation, and any contracts with fund-raising counsel.

- Answer all background information questions truthfully, providing explanations where necessary and attaching additional sheets if required.

- Ensure all names and addresses of affiliated branches, officers, directors, and trustees are included and correctly formatted.

- Review and complete the acknowledgement section, ensuring you understand the obligations related to solicitation and reporting.

- Finalize the application by signing and dating the affidavit. Include notarization as required. After reviewing the completed application, save changes, download, or print the document for submission.

Complete your Charitable Organization Registration online today to ensure your compliance with Georgia's regulations.

To start a nonprofit in Georgia and get 501c3 status, follow these steps: Step 1: Name Your Georgia Nonprofit. Step 2: Choose Your Registered Agent. Step 3: Select Your Board Members & Officers. Step 4: Adopt Bylaws & Conflict of Interest Policy. Step 5: File the Articles of Incorporation. Step 6: Get an EIN.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.