Loading

Get Form Rd 105

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form RD 105 online

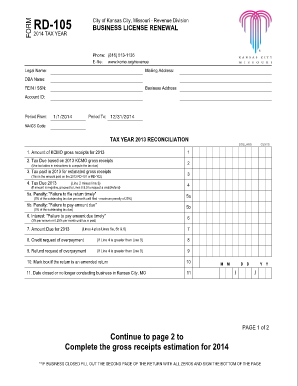

Filling out the Form RD 105 online is an essential step for businesses renewing their licenses in Kansas City, Missouri. This guide will provide a clear and supportive overview of each section of the form to ensure a successful submission.

Follow the steps to complete the Form RD 105 online effectively.

- Press the ‘Get Form’ button to access the RD 105 form and open it in your browser's editor.

- Fill out the legal name, mailing address, and doing business as (DBA) name. Ensure accurate entry for the FEIN or SSN, business address, and account ID.

- Enter the reporting periods, including the 'Period From' starting date of 1/1/2014 and 'Period To' ending on 12/31/2014.

- Complete the NAICS code that corresponds to your business type. You may need to reference your federal income tax return for this.

- On Page 1, provide the KCMO gross receipts for 2013, calculate the tax due using the appropriate tax tables, and report the tax paid from the previous year.

- Calculate any penalties or interest applicable if the return is filed late and complete the line for the total amount due.

- If applicable, request a credit or refund for overpayment on subsequent lines.

- On Page 2, estimate the gross receipts for 2014 based on prior year’s figures and fill out the corresponding tax due.

- Enter information regarding any penalties and interest for late filings on Page 2.

- Review all entries for accuracy and completeness, ensuring all required fields are filled.

- Once finished, you can save your changes, download the completed form, print it for your records, or share it if needed.

Start completing your documents online today for a smooth filing experience.

Taxpayers who decide they need to visit an IRS Taxpayer Assistance Center for in-person help with their tax issues should do a couple things first. First things first, taxpayers will need to call 844-545-5640 to schedule an appointment. All TACs provide service by appointment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.