Loading

Get 2012 Instruction 1040 Schedule C - Internal Revenue Service - Taxhow

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Instruction 1040 Schedule C - Internal Revenue Service - Taxhow online

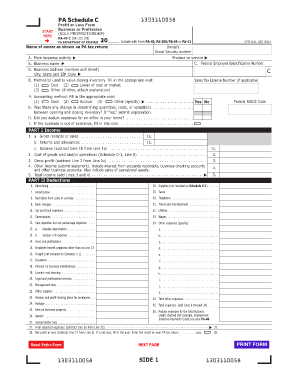

This guide provides clear, step-by-step instructions on how to fill out the 2012 Instruction 1040 Schedule C form online. Designed for both experienced users and those new to tax forms, this resource aims to simplify the process of reporting income or loss from a sole proprietorship.

Follow the steps to successfully complete your Schedule C online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the identification information: Enter the owner’s name as shown on the PA tax return, followed by the owner's Social Security Number.

- Provide the business details: Fill in the business name and address, including city, state, and ZIP code.

- Indicate the main business activity by describing it and providing the appropriate NAICS code.

- Specify the federal Employer Identification Number if applicable and enter the sales tax license number if you have one.

- Select the method used for valuing closing inventory and the accounting method, marking the appropriate ovals.

- Answer questions regarding inventory changes, deductions for office use at home, and whether the business is out of existence.

- In Part I, report all income: Start with gross receipts or sales, subtract returns and allowances, and calculate the balance.

- Compute the cost of goods sold and total income, adding other income sources if applicable.

- In Part II, list all business expenses: Fill out each deduction line with accurate figures and total all expenses.

- Calculate net profit or loss by subtracting total adjusted expenses from total income.

- Review the form for accuracy and completeness before saving your changes, downloading, or printing the completed form.

Complete your 2012 Schedule C online to ensure accurate reporting of your business income.

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.