Loading

Get Rf 1209

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rf 1209 online

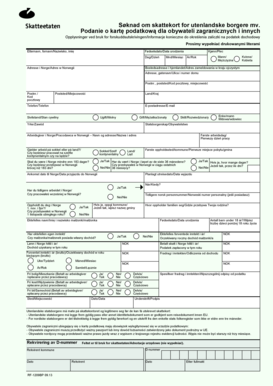

The Rf 1209 is an important form for foreign citizens applying for a tax card in Norway. This guide provides clear, step-by-step instructions to assist you in filling out the form accurately and conveniently online.

Follow the steps to complete the Rf 1209 effectively.

- Press the ‘Get Form’ button to access the document and open it in your preferred editor.

- Begin filling out the form by entering your last name and first name in the designated fields.

- Enter your address in Norway in the specified field, including street name and house number.

- Indicate your gender by selecting either 'Mann' (male) or 'Kvinne' (female).

- Fill in your residential address in your home country, including street address, postal code, and city.

- Include your contact information: telephone number and email address.

- Select your marital status from the options provided: 'Ugift' (single), 'Gift' (married), 'Enke/mann' (widowed), or 'Skilt' (divorced).

- Enter your occupation and citizenship details.

- If applicable, provide your employer's name and address in Norway along with your first working day.

- Indicate if your work will be on the continental shelf or on land by selecting 'Sokkel' (shelf) or specifying 'land.'

- Respond to inquiries about your planned stay in Norway, including expected duration and any previous stays within the last 36 months.

- Complete additional questions regarding your spouse's income, children under 18, and expected earnings for the current year.

- If applicable, specify any deductions to be made from your income.

- Indicate if you are receiving any benefits from your employer, such as free housing, food, or transportation.

- Review all filled information for accuracy and completeness before proceeding.

- Once finished, save your changes, and choose to download, print, or share the completed form as necessary.

Start filling out the Rf 1209 online to ensure you have your tax card ready for your stay in Norway.

This can be used to record your employee's tax and Pay Related Social Insurance (PRSI) contributions. You can click 'Calculate' at the top of the TDC when you complete the Total Tax Credit and Total Cut-Off Point boxes. This will auto-fill the Cumulative Tax Credit and Cumulative Cut-Off Point columns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.