Loading

Get Beer And Wine Importer Tax Return - Board Of Equalization - State Of ... - Boe Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Beer And Wine Importer Tax Return - Board Of Equalization - State Of California online

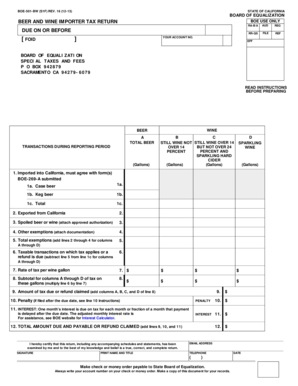

This guide provides clear and supportive instructions on how to complete the Beer And Wine Importer Tax Return, a crucial requirement for all licensed beer and wine importers in California. By following these steps, users can ensure accurate reporting of their taxable transactions online.

Follow the steps to effectively complete the Beer And Wine Importer Tax Return online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the introductory instructions provided on the form to understand the filing requirements and key deadlines.

- Fill in your account number in the designated field at the top of the form.

- Complete section A by entering the total gallons of case beer imported into California, ensuring that this figure aligns with reports submitted on form BOE-269-A.

- In section B, report the total gallons of keg beer imported by converting barrels into gallons, again ensuring conformity with prior reports.

- Calculate the total gallons of beer and wine imported and enter this value in section C, rounding to the nearest gallon as needed.

- Continue with section D to report any exports from California and include supporting documentation if necessary.

- If applicable, detail spoiled beer or wine in section E, attaching any required authorizations.

- For any other exemptions, document these in section F, along with the necessary verification.

- Add lines 2 through 4 to determine total exemptions in section G and then calculate taxable transactions by subtracting line 5 from line 1c in section H.

- Input the rate of tax per wine gallon in section I and compute the subtotal of tax based on taxable gallons.

- In section J, aggregate any tax due or refunds claimed across all relevant columns.

- If applicable, calculate any penalties for late filings and interest due if payments are delayed; enter these amounts in sections K and L.

- Finally, add the total amount due and any refunds requested in section M before validating the correctness of all entered information.

- Once all data is entered accurately, save changes, and consider downloading or printing the completed form for your records.

Complete your Beer And Wine Importer Tax Return online today to ensure compliance and avoid late fees.

The BOE has a major role in California's property tax system. The BOE is responsible for assessing property owned or used by railroads and privately- held public utilities, and for ensuring statewide uniformity in the assessment of properties by the 58 county assessors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.