Loading

Get 2014 Form W-4p - Ipers - Ipers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 Form W-4P - IPERS - Ipers online

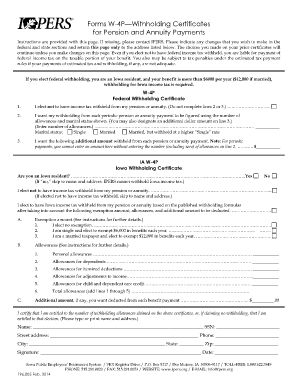

Filling out the 2014 Form W-4P is essential for informing your payer about the federal and Iowa state tax withholding from your pension and annuity payments. This guide provides you with a comprehensive overview of each section and field to help you complete the form accurately and efficiently online.

Follow the steps to effectively fill out the form online.

- Press the ‘Get Form’ button to access the form and open it in your chosen form editor.

- Begin by completing your personal information at the top of the form, including your name, social security number, and address.

- In the Federal Withholding Certificate section, choose whether you want to have federal income tax withheld: Check the box if you do not want any federal tax withheld (line 1), or indicate the number of withholding allowances and marital status (line 2). If applicable, specify any additional amount you want withheld on line 3.

- Proceed to the Iowa Withholding Certificate section. Indicate if you are an Iowa resident by checking 'Yes' or 'No.' If you choose to have Iowa income tax withheld, follow the guidelines to fill in the exemption amount and allowances.

- Complete the Personal Allowances Worksheet to determine the number of allowances you can claim. Fill in numbers for personal allowances, dependents, and any adjustments or credits accordingly.

- Review the completed form to ensure accuracy, making any necessary changes before finalizing.

- Once satisfied with your entries, save your changes, and you may choose to download, print, or share the completed form as needed.

Take the next step in managing your pension and annuity payments by completing the 2014 Form W-4P online today.

There are a few different ways to become a vested IPERS member. Regular Member: Beginning July 1, 2012, you become a vested member when you accrue seven years (28 quarters) of service or are at least age 65 working in covered employment, whichever occurs first.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.